A first in the market to cover up to four family members in one policy

Leading life insurer Pru Life UK launches PRUHealth FamLove, a protection plan that shares the critical illness coverage to up to four family members in one policy, a first-of-its-kind product in the market. This is available for all Filipino families, including same-sex or common-law partners, parents, and adoptive children.

PRUHealth FamLove is a yearly renewable protection plan that provides long-term coverage until age 85 (applicable when the premium is continuously paid), against high treatment and hospitalization costs due to critical illness.

According to a 2019 study by Mercer Marsh Benefits*, critical illness cost in the Philippines is the second most expensive in South East Asia. Lung cancer treatment costs can lead up to Php 2.78 million, stroke is for Php 1.8 million, while a heart attack is for Php 980,000**.

Having critical illness protection is important as costs including long-term medication and care, and even loss of income can be covered by the plan’s critical illness benefits through the System and Organ Function Insurance (SOFI) concept. This feature makes the product unique in the market as it provides coverage should any major organs require surgery, without the need to remember the long list of critical illnesses.

PRUHealth FamLove is flexible and easy to avail as it comes in different packages, with the option to choose how many family members will be covered from one (self) to

three – mySelf, myPartner, myChild, myFamily, myParent – depending on what suits the family’s protection needs.

“Pru Life UK celebrates and nurtures every Filipino family of different types and sizes with PRUHealth FamLove. This protection plan focuses on their ever-changing needs by offering critical illness protection to the whole family,” shared Pru Life UK President and Chief Executive Officer Eng Teng Wong.

“This innovation is a solid testament to our continuing commitment to promote financial inclusion by providing protection coverage to millions of underserved and unserved Filipinos to get the most out of life,” Wong added.

For more detailed information about PRUHealth FamLove, customers may visit the Pru Life UK website or book an appointment with a Pru Life UK insurance agent.

This is the latest product offering from Pru Life UK, ranked number one by the Insurance Commission in terms of New Business Annual Premium Equivalent in 2021.

References:

*8 Dec 2020. Philippines’ Healthcare Cost Inflation Projected to Hit 10.1% in 2020: Mercer Marsh Benefits Study. https://www.asean.mercer.com/newsroom/philippines-healthcare-cost-inflation-mmb-study.html

** Cost of Critical Illness in the Philippines. https://digitalpinas.com/cost-critical-illness-philippines/

About Pru Life UK

Established in 1996, Pru Life UK is the pioneer of insuravest, or investment-linked life insurance products, in the Philippines and is one of the first life insurance companies approved to distribute US dollar-denominated investment-linked life insurance policies in the country. Since its establishment, Pru Life UK has expanded its reach to over 190 branches in the Philippines, with the biggest life agency force of about 35,000 licensed agents.

The company ranked first (1st) among the country’s life insurers based on the Insurance Commission’s Full Year 2021 rankings in terms of new business annual premium equivalent. Pru Life UK is headquartered in Uptown Bonifacio, Taguig City.

Pru Life UK and Prudential plc are not affiliated with Prudential Financial, Inc. (a company whose principal place of business is in the United States of America), Prudential Assurance Company (a subsidiary of M&G plc, a company incorporated in the United Kingdom), Philippine Prudential Life Insurance Company, Prudentialife Plans, Inc. or Prudential Guarantee and Assurance, Inc. (all Philippine-registered companies). Pru Life UK is a life insurance company and is not engaged in the business of selling pre-need plans.

For more information: www.prulifeuk.com.ph

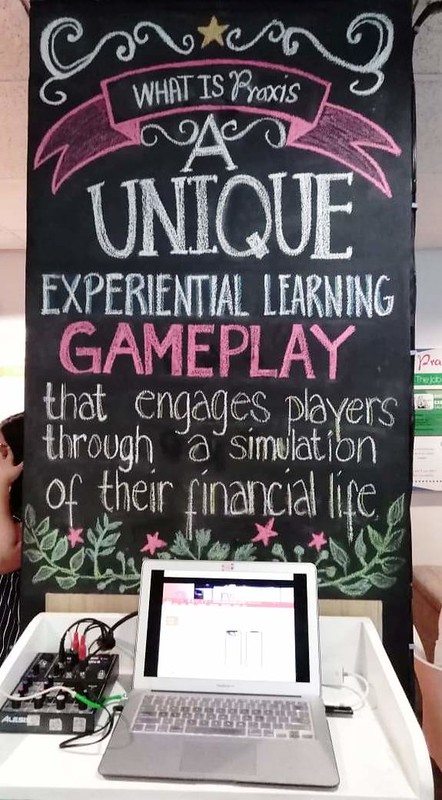

About Pulse

Pulse is an all-in-one app that offers holistic health and wealth management solutions to consumers. Powered by Artificial Intelligence (AI), Pulse serves as a health and wealth partner to users. It is designed to help people prevent, postpone, and protect against the onset of diseases, as well as make informed financial decisions to protect and grow their wealth.

Pulse is part of Prudential’s strategy to make healthcare and financial security more accessible to more people by leveraging digital technologies and best-in-class partnerships. Launched in Malaysia in August 2019, Pulse is active in 17 markets and 11 languages in Asia and Africa, and has been downloaded more than 32 million times (as at Dec 2021).

Pulse is currently available on the Apple/Google Play stores in Cambodia, Hong Kong, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Taiwan, Thailand, Vietnam in Asia, and Cameroon, Ghana, Kenya, Nigeria, Uganda and Zambia in Africa.

For more information, log on to www.wedopulse.com.